While many faith-based high schools have significant alumni support, and have development or advancement directors to coordinate activities designed to interest potential donors and continually engage current donors, elementary schools seem to struggle with the fact that they NEED a development or advancement director to do the same. Schools will say they don’t have it in the budget, and then simply try more and more fundraisers which put more and more stress on current parents which causes more and more parents to disenroll their students, which leads to school mergers and closures.

The fact of the matter is that ALL tuition-charging schools need an experienced individual to lead donor-centric activities, rather than parent-centric “additional” tasks when parents have a financial obligation to pay tuition. Indeed, it takes a community to support a school. While parents struggle and sacrifice to make tuition payments so their children can take advantage of the educational environment they desire, others need to be involved in giving of their time, talent and treasure to create financial aid resources to assist in the enrollment of additional students by making the price point affordable through the application of financial aid based on financial need and scholarship based on academic success.

Why is it important for elementary schools to employ what high schools are doing? Just look at tuition amounts today as compared to those over 40 years ago.

In the late 1970’s, Catholic high school tuition was about $800 a student. That doesn’t sound like much today, does it, since today, that figure is more than likely over 5 figures. Interestingly, Catholic high school tuition of one student is about what the average household income was in 1978 – $13,650 (Source: https://www.davemanuel.com, accessed 6.18.2021).

$800 was 5.8% of that average household income, and financial aid was necessary for quite a number of families.

In 2022, the average household income in this nation reached $87,684 (Source: https://www.thebalance.com/what-is-average-income-in-usa-family-household-history-3306189, accessed 6.14.23). With tuition around the $11,240 per student mark at the average faith-based high school, that’s almost 12.8% of the average household income, and financial aid programs are definitely a necessity.

Using a figure of $4,840 as the average per-student tuition at a faith-based elementary school (Source: https://educationdata.org/average-cost-of-private-school, accessed 6.14.2023), that’s 5.5% of the average household income. So if financial aid was needed when tuition was at the 5.8% level for a Catholic high school experience 45 years ago, it stands to reason that financial aid would be needed at the 5.5% level for an elementary school experience today!

Perhaps you’re thinking, “But we don’t have enough financial aid to give them!”

And that’s precisely why you need someone to get it!

Someone who’s experienced, knows what needs to be done, is able to create connections, and can execute the strategies and tactics necessary for success.

Not a teacher, since the teacher’s role is “inside” the school building with the children for most of the school day. The Advancement/Development Director needs to be out in the community among alumni, businesses, community members and leaders, and donors.

Not a parent volunteer, either, since this position is critical to your school’s continued existence. While you may consider hiring a “part-timer,” this critical position is a very full-time job. Ask anyone that does it.

Now you’re thinking, “But we work really hard to keep our tuition low.”

And how’s that been working for you?

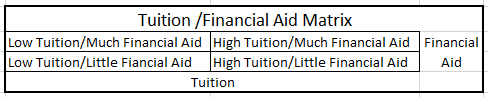

Here’s the thing. You can have low tuition, high tuition, or even the cost of education as your tuition (Truthfully, your tuition should be even MORE than your cost of education, but that’s another topic for another day). You can have little financial aid, or an abundance of financial aid. Even if you don’t have any funds for financial aid, bear with me through this explanation as to how you create financial aid.

A 2 x 2 matrix is created when you combine these four factors:

- Low tuition, little financial aid

- Low tuition, much financial aid

- High tuition, little financial aid

- High tuition, much financial aid

Here’s what happens in each scenario:

Low tuition, little financial aid

I’ve spoken with teachers that have lamented the fact that “their tuition is just too high.” At one school in particular, when I asked what the full tuition for the first student at the school was (since there are lower tuition amounts for 2nd and 3rd children in the family), one teacher responded, “$1,900. That’s a lot of money.”

While you may wish your school’s tuition was that low, the fact of the matter is that ANY four-digit number is viewed to be “a lot of money.” Five-digit tuitions are even scarier territory to enter. I responded by asking, “How many hours per year are your students in school?” their answer was “990.” I said, “That’s almost 1,000 hours of classroom instruction per year. Do you realize that full tuition is less than $2 an hour?” The teacher’s response was, “Wait…that’s all?”

And that’s the response you want from your families. Unfortunately, many families pay significantly more than that for their children’s education. Schools desire to keep the tuition low to attract more families, but then offer little financial aid, as if the effort that goes into keeping costs low will impress the parents.

It doesn’t.

Keeping tuition low puts the focus on the school, rather than putting the focus on the parents and their child. It’s like a salesperson that’s just looking to make a sale rather than keeping the best interest of the customer at the forefront of the discussion. If this type of tuition conversation doesn’t change, the school will be in for, or may even be currently in, some difficult times.

Low tuition, much financial aid

I see this scenario in schools that don’t utilize a third-party financial need calculation provider. Families say that they can’t pay tuition, and need aid to do so. Some schools have even asked, “What can you pay?” Then, the school accepts that amount as a “fair tuition.” Unfortunately, what happens if a hardship befalls the family during the year and they can’t fulfill that payment obligation? What happens if that family tells all their friends that they’re not paying the remainder of their tuition for the year? Sure, we all hope the matter is kept confidential, but if you get “a great deal” on a purchase you make, do you keep it to yourself, or tell your friends about it?

Awarding too much financial aid isn’t a prudent thing to do, especially if you “work extremely hard” to keep costs as low as possible, and therefore keep tuition as low as possible (see above).

High tuition, little financial aid

In this scenario, it’s very easy to see that unless its parent community is financially affluent, there is little hope for the school’s future.

High tuition, much financial aid

For most faith-based schools which serve a diverse community, this is the only model that is sustainable. Note that your tuition doesn’t have to be equal to the cost of education, but it can be BASED on the cost of education (hence the name, cost-based tuition), rather than basing it on how much of a tuition increase your administrators believe that parents will absorb with as little pushback as possible. Your financial aid funds could consist of development dollars raised, a certain amount from each full-pay tuition student, and tuition reduction. Yes, even when the financial aid runs out, you can still offer families financial aid by simply reducing their tuition, but based on the family’s financial need (creating the name, need-based aid).

One of the most prevalent objections I’ve heard regarding financial aid is, “We don’t want to charge families a fee to apply for financial aid.”

Then don’t. Increase the tuition by $50 to cover the cost of an application for financial aid, and then the school can pick up the cost.

Why do this? When parents don’t have to pay for financial need assessment, potentially all families will apply – even those that have no financial need and significant income. They’re applying simply because it’s done at no additional cost to them, and you don’t get anything unless you ask for it. The bonus is that you’ve just “wealth screened” the family, and, if they are in a position to make a contribution to your development efforts, they could be kept on a list for the school’s annual appeal once their children are no longer in the school.

If you’re considering this, be sure to keep in mind that ALL families may decide to apply for financial aid because the school is paying for the application. Let’s say your school has 200 families, and the application cost per family is $40. That’s $8000 that the school will need to add to its budget. School board or finance council members may take a look at that and say, “Well, let’s just cut that out of our budget if we’re trying to cut costs.” Others, I’m sure, would agree.

Here’s the thing – that’s the “simple” solution, NOT the “strategic” one.

And, as H. L. Mencken has been quoted as saying, “For every complex problem there is an answer that is clear, simple, and wrong.”

One school I worked with a number of years ago found a way to keep parents paying tuition on time using financial aid as well. There is no late fee for late tuition payments; the parent simply loses the financial aid award. While no parent has lost their financial aid, the policy motivates the parent to communicate hardships with the school’s administrators, allowing adjustments to be made accordingly.

Why put such a radical policy in place?

The school believes that tuition payment is a covenant, and not simply a contract. The school awards financial aid based on the fact that the parent has promised to pay tuition over a series of months.

It’s a great lesson in accepting responsibility and fulfilling obligations, which is a lesson that some of today’s parents, as well as children, need to learn.